Customer Management (KYC)

Have full insight in your customer details and needs at any time.

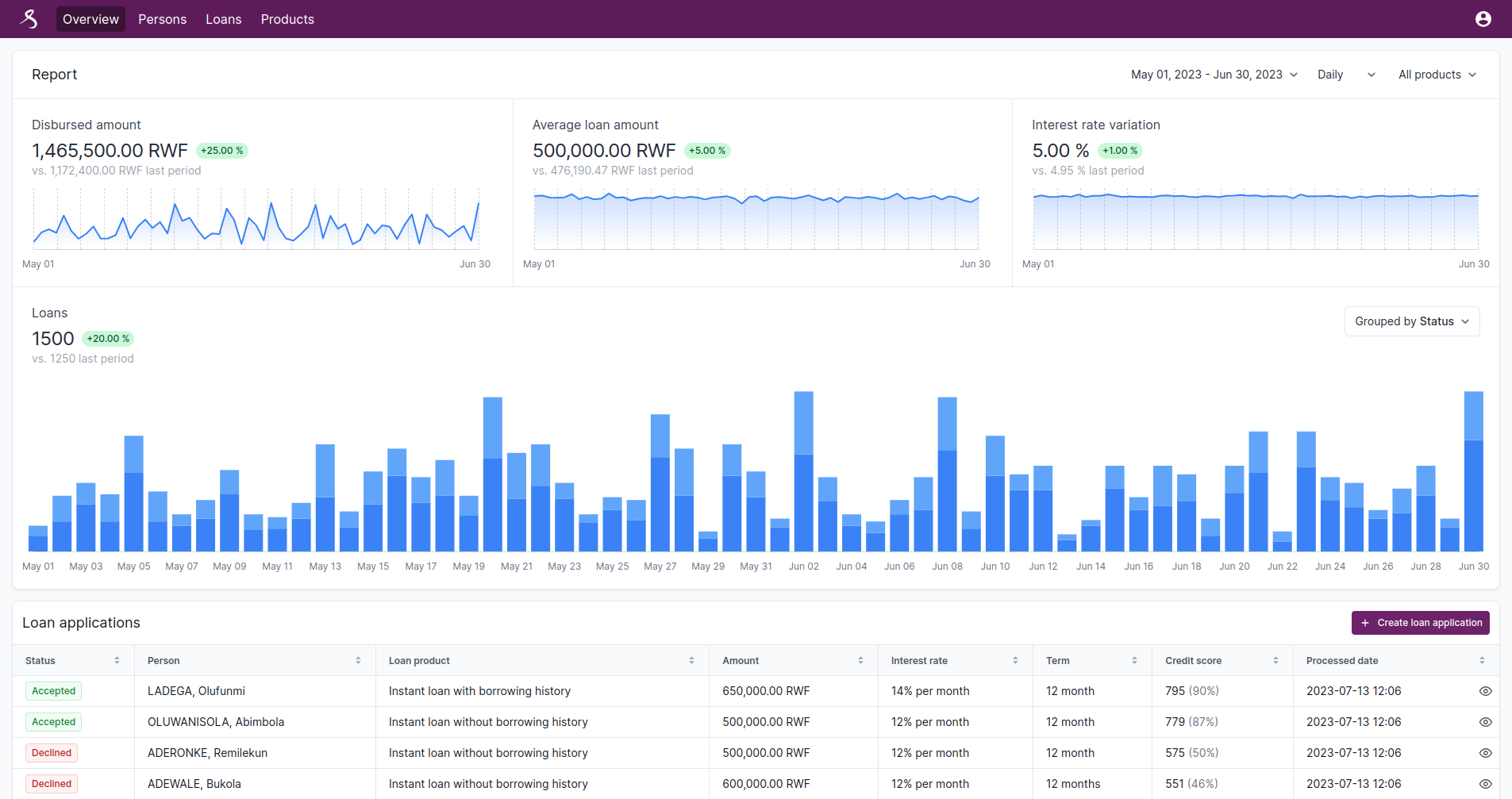

Turning operations into a competitive advantage to financial institutions of any size, by streamlining and automating end-to-end lending processes

Software in the financial sector does not need to lag behind innovation. That's why we built a solution from the ground up that reimagines the way financial institutions operate.

Have full insight in your customer details and needs at any time.

Fully automate your loan origination by using our cutting-edge system.

By using our scorecard engine you can be sure that the right customer gets the right loan.

We make it simple to generate and store necessary documents to provide your customer a loan, which can be retrieved at any time.

Use your own workflows in our system, to create a perfect interaction between your organisation and our software.

Be in full control when it comes to data collection and recovery, minimizing your administrative burden and maximizing your customer satisfaction.

The multi-tenancy SaaS architecture of Simbuka enables low-cost deployment, greatly decreasing the cost of supporting the install base.

Whenever you want. Wherever you are. Simbuka is available on your desktop, laptop, tablet, or smartphone.

We can provide truly unique solutions for any requirements you have because our tools are highly modular.

Interested in a demonstration of how our loan management system can help your business? Contact us and our sales team will do the rest!